In regards to safeguarding your property, getting the correct household coverage answers might make a world of change. Whether or not you are a homeowner, renter, or simply beginning, knowing your insurance policies solutions is essential. Property insurance policies remedies are meant to provide fiscal protection in case of hurt, theft, or unexpected situations. But with countless selections out there, how Did you know what fits your preferences the most beneficial? Enable’s take a further dive into this matter and explore the different components of dwelling insurance policy.

At its core, property insurance policy answers are all about satisfaction. Image this: you’ve just acquired your desire dwelling, and you also’ve invested time, money, and energy into making it your own. But then, a natural disaster strikes or a collision occurs. With no right coverage, Individuals investments can be in danger. Household insurance coverage may also help include The prices of repairs or replacements, making sure you won't need to face the financial load alone.

One vital consideration when exploring residence insurance plan solutions is the kind of coverage you need. There are plenty of sorts of property insurance guidelines offered, from simple insurance policies that go over the construction of your property to more complete ideas that safeguard each your private home and your individual possessions. For example, homeowners insurance policies commonly includes coverage for your own home’s framework, individual assets, liability, and additional residing expenses in the event your own home gets to be uninhabitable.

All about Affordable Life Insurance Solutions

You could be asking yourself, what exactly is covered beneath house insurance policies? Effectively, property insurance policy normally addresses the four most important parts: the composition of your home, particular assets, liability, and extra residing expenses. For the framework, it incorporates safety versus fireplace, storms, vandalism, and also other occasions That may problems your own home. Personalized home coverage protects your belongings, like household furniture, electronics, and clothes, in case They may be destroyed or stolen. Legal responsibility coverage can help secure you if another person is injured on your own home, and additional living charges address short term dwelling expenses if your own home is rendered uninhabitable.

You could be asking yourself, what exactly is covered beneath house insurance policies? Effectively, property insurance policy normally addresses the four most important parts: the composition of your home, particular assets, liability, and extra residing expenses. For the framework, it incorporates safety versus fireplace, storms, vandalism, and also other occasions That may problems your own home. Personalized home coverage protects your belongings, like household furniture, electronics, and clothes, in case They may be destroyed or stolen. Legal responsibility coverage can help secure you if another person is injured on your own home, and additional living charges address short term dwelling expenses if your own home is rendered uninhabitable.Now, Allow’s consider a more in-depth examine ways to pick the correct home insurance Remedy in your scenario. Start off by assessing the worth of your private home and belongings. Do you've got precious objects, like artwork or jewelry? These might require extra coverage, which can be added in your plan. Subsequent, think about the threats your house faces. Will you be in a region prone to flooding or earthquakes? If that's so, you would possibly need to have specialized coverage, given that most regular household insurance plan insurance policies Do not deal with All those forms of activities.

It’s also essential to think about your spending plan when shopping for home insurance policies. Although it’s tempting to Choose the cheapest option, one of the most very affordable insurance plan might not offer you the most effective defense. Getting the harmony concerning cost and protection is critical. Try to look for guidelines that supply comprehensive protection without having breaking the bank. A better deductible may well reduce your premiums, but it also indicates you may fork out a lot more away from pocket if a claim is built. So, take into consideration what you can manage to pay for upfront and decide on accordingly.

Besides the Expense, you should also Test the standing from the insurance provider you happen to be thinking about. Not all insurance coverage providers are created equal. You wish to opt for a business which is dependable and it has a background of handling promises relatively and proficiently. Reading on the internet reviews and examining the company’s rankings with organizations like the greater Small business Bureau can present you with an strategy in their customer support and promises process.

As well as the protection by itself, A different important factor Go here in home coverage solutions is the exclusions. Just about every policy provides a set of exclusions—situations that are not coated. Popular exclusions involve flood and earthquake injury, as these typically call for different protection. Comprehension what isn’t covered in your coverage is just as crucial as figuring out what is. This fashion, you'll be able to system for any additional coverage you might require.

A different typically-overlooked element of household insurance policies alternatives is the potential for discounts. Did you know that you could potentially decreased your premiums by bundling your home insurance Full info with other insurance policies, like automobile coverage? Numerous companies offer discounts if you insure numerous Houses or have specific basic safety characteristics in your home, like safety methods or fireplace alarms. Constantly inquire your insurance Discover everything policy supplier about any potential special discounts which will apply for you.

Insurance Benefits Fundamentals Explained

Allow’s not ignore renters insurance coverage, which happens to be a type of dwelling insurance policies solution designed for tenants. Renters insurance provides similar coverage to homeowners coverage but applies only to your contents of your respective rental assets. For those who lease an condominium or home, renters insurance policy can shield your possessions from harm or theft. It’s An easily affordable option that provides assurance with no expense of insuring the complete constructing.In relation to property insurance coverage remedies, it’s not almost the material elements of your private home. There’s also the emotional value tied to your location you get in touch with household. Take into consideration the time and effort you have place into your Room. If anything were to occur, it’s not simply the monetary reduction that’s concerning but will also the Reminiscences and ordeals connected to your own home. Coverage can assist restore what’s misplaced, nonetheless it’s crucial to have the right coverage to do so efficiently.

The process of submitting a claim is often scary For lots of homeowners, Which is the reason picking out an insurance policy provider with a straightforward claims procedure is very important. Ahead of purchasing a coverage, take the time to understand how the claims procedure functions with your decided on service provider. Are claims taken care of on the web, or do you have to make cellphone phone calls? Is there a focused aid staff To help you? A hassle-cost-free statements course of action will make a substantial variance all through stressful occasions.

Another crucial factor in residence insurance policy alternatives is the extent of personalization offered. Every person’s wants are distinct, so it’s important to perform using an insurance plan service provider who can tailor a plan to fit your exclusive circumstances. Regardless of whether you’re a primary-time homeowner or else you’ve owned numerous Qualities, obtaining a versatile and customizable plan will make sure you're adequately lined to your precise demands.

Things about Professional Insurance Solutions

If you live in a superior-threat place, house coverage solutions may possibly consist of excess protection for specific threats. As an example, parts susceptible to hurricanes may possibly need additional windstorm protection, though Qualities in flood-susceptible locations may need flood insurance. Usually evaluate the threats in your town and go over them along with your coverage agent to be certain your plan addresses Individuals distinct wants.

Another choice to look at is property warranty coverage. Whilst household insurance policies shields from unanticipated gatherings like accidents or harm, household warranty insurance policy normally handles the cost of repairs and replacements for home techniques and appliances that stop working on account of usual use and tear. When you have an older property with growing old appliances, this kind of coverage can assist simplicity the economical strain of unforeseen repairs.

From the age of technology, dwelling coverage remedies have gotten more available and easier to control. Quite a few providers present on line tools and cell apps that allow you to deal with your coverage, file claims, and perhaps observe your premiums. Using these equipment, it’s more simple than ever before to stay along with your protection, make changes, and acquire guidance when needed.

It is important to periodically review your own home insurance policy to make certain it proceeds to satisfy your preferences. As your lifetime evolves—whether it’s purchasing new items, building household advancements, or going to a special site—your protection ought to reflect those changes. Frequently reassessing your property insurance coverage will ensure you’re often adequately secured and not paying for avoidable coverage.

When you’re in the marketplace for residence insurance coverage options, don’t hurry the procedure. Get your time to research distinct companies, Examine policies, and talk to issues. Don't forget, dwelling insurance plan is just not a one-size-suits-all solution. The ideal policy for you relies on your Life style, the value of one's house, as well as risks you experience. So, take the time to choose properly and spend money on the protection that’s good for you and your home.

Freddie Prinze Jr. Then & Now!

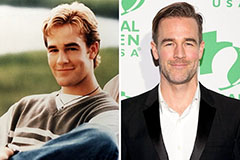

Freddie Prinze Jr. Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now!